Passive/Destructive Leadership in Monetary Policy: The Trap of Multiple Objectives and the Necessity of Redefining Central Bank Independence

Introduction

Amid Iran’s economic transformations, the revision of the Central Bank law has become a serious controversy. The adoption of multiple objectives and the repeated interventions of the government and parliament have placed the Central Bank in a situation that closely resembles organizations trapped in passive or destructive leadership. This article, drawing upon an organizational consulting analysis and integrating the Iranian compassionate leader archetype with the USPT model, examines both the diagnostic and strategic aspects of this dilemma.

Passive/Destructive Leadership: Concept and Organizational Reflection in Economics and Policy

In management literature, “passive/destructive leadership” refers to a condition where an organization, instead of actively responding to environmental changes and continually learning, merely settles for maintaining the status quo and repeating existing routines. In such organizations, the effective flow of information and feedback is weakened, gradually disconnecting the system from its environment and leading to stagnation, diminished innovation, and strategic inertia. This approach not only eliminates the possibility of transformation, but when it reaches the top of a larger structure—such as the macroeconomy—it deprives it of the ability to respond to changes and new challenges.

Multiple Objectives and Directives: Reproducing Passive/Destructive Leadership

When legislators or policymakers oblige the Central Bank to pursue diverse and sometimes conflicting objectives (such as controlling inflation, economic growth, employment, and justice), they essentially create conditions similar to those in organizations trapped by passive or destructive leadership. This approach diverts the specialized institution from its “core mission”—stabilizing the money market and controlling inflation—and, rather than fostering effective engagement, drives it to react defensively to external shocks and mandates.

In such an atmosphere, the numerous and uncoordinated directives from the government and parliament undermine the real meaning of targeted regulation. Rather than developing a creative and learning role, the Central Bank becomes caught in a downward spiral of responding to short-term demands and external criticisms—mirroring the same symptoms observed in organizations suffering from passive or destructive leadership: reactivity, maintaining the current state, and an inability to generate innovation.

Strategic Diagnosis: A USPT-Based Perspective

According to the USPT model, there is an urgent need for reforms under these conditions. Continuing on this path not only threatens macroeconomic sustainability (Urgency) but also leads to the erosion of public trust and the depletion of institutional capital (Significance). Nevertheless, there is still potential to escape this trap: If the Central Bank achieves operational independence, task separation, and transparent engagement with the scientific and global community, it will reactivate the foundation for innovation and learning (Potential). However, if passive behavior persists, it will pose a deep threat of managerial and institutional stagnation, destroying any hope for growth and transformation (Threat).

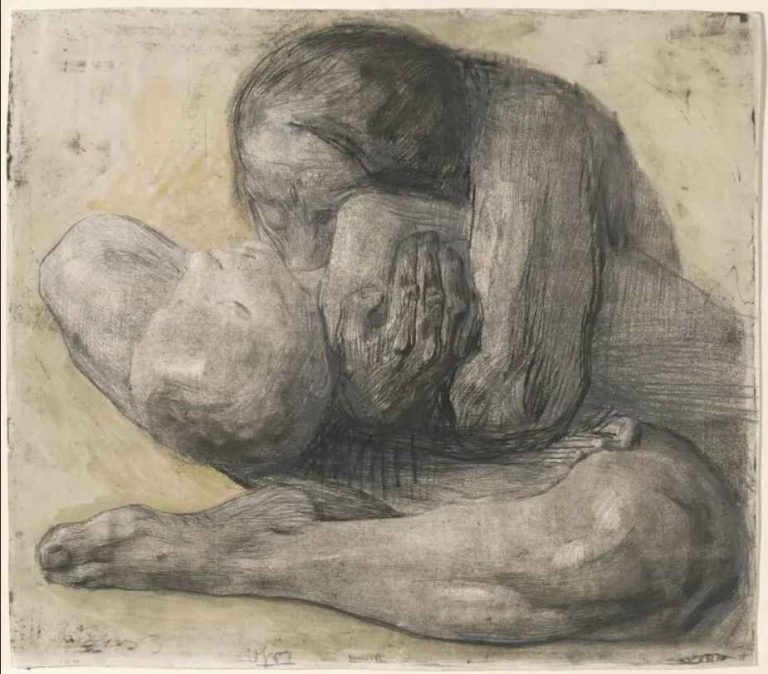

The Compassionate Leader and the Path Out of Passivity

The exit from this deadlock requires a return to models of compassionate, learning, and adaptive leadership—leaders who, instead of holding on to the past, welcome feedback, update institutional procedures, and turn decision-making into a center of dialogue, transparency, and genuine support. This is the fundamental difference between an organization captured by passive/destructive leadership and one that is vibrant, innovative, and responsive.

Summary and Strategic Recommendation

In light of this analysis, five essential recommendations are proposed:

First, an urgent revision of the Central Bank law with a clear focus on fundamental objectives (i.e., price stability and inflation control) must be prioritized. Second, a clear and institutional separation between the Central Bank’s monetary policy and the fiscal policy of the government must be implemented so the Central Bank can recover its true regulatory role. Third, a discourse of professional expertise should prevail in the processes of lawmaking and policymaking, and unsubstantiated intervention without technical backing must be avoided. Fourth, transparency in monetary decisions and the realization of operational independence for the Central Bank is vital. Finally, establishing mechanisms for ongoing monitoring and early warning at the macroeconomic level is essential to maintain the integrity of the structure and prevent a relapse into passive/destructive leadership.

Closing Message

Like any organization or human network, the politico-economic structure—if trapped in passive/destructive leadership, isolated from feedback, and reliant solely on decrees and shocks—will eventually face warning signals and even disintegration. The salvation of this system lies in a return to active, expertise-driven support, persistent transparency, and a focus on each institution’s authentic responsibility. A compassionate and learning leader is the ultimate key for the transition from repetition and stasis toward a dynamic and balanced future.